Great Advice, Straight From The Heart

Planning for the future

At Lifetime Solutions Ltd, we specialise in arranging your estate planning needs so you can have peace of mind that if or when the worst happens, your personal affairs and your family will be taken care of.

Request a callback

Chat to us for free and

impartial advice

Free Consultation

Free Will Storage for Life

Free Entry onto the National Will Register

Fully Transparent

How we work

What We Do

Whether you are in need of support on preparing Powers of Attorney, simple Mirror Wills, or if you require more specialised legal advice on protecting your estate by using Will Trusts, our team can help you achieve the right solution.

We also provide FREE Will Storage and registration on the National Will Register is included.

You can expect us to:

- Explain your options

- Answer any questions you have

- Walk you through the process

- Deal with all document preparation

- Deal with all court applications

- Ensure your wishes are recorded correctly

How we do it

Super Simple Process

At Lifetime Solutions, we will lead you through the process step-by-step and give you the guidance you need to ensure all your documents are set up quickly and efficiently.

Our costs

Pricing

| Product | Client Fee |

| UK Simple Will (Single) | £ 149.00 |

| UK Simple Will (Mirror) | £ 249.00 |

| Lifetime Will Storage | FREE |

| Registration on the National Will Register | FREE |

| England & Wales Document Preparation (Including OPG Registration) | Client Fee |

| One Lasting Power of Attorney Document’s (Single) | £ 495.00 |

| Two Lasting Power of Attorney Document’s (Single or Couple) | £ 695.00 |

| Four Lasting Power of Attorney Document’s (Couples) | £ 1,195.00 |

Registration with the Office of the Public Guardian is £82 per LPA document. This is the fee charged by the court.

If you are in receipt of certain benefits, you can apply for free registration with the OPG. If you have an income of £12,000 or less, you can apply for a 50% discount on the fees.

Lifetime Solutions will assess your eligibility and help you complete the required forms for this as part of our service.

All Wills include free lifetime storage of your original Will and registration on the National Will Register.

| Package Deals (Registered) | Client Fee |

| UK Will & One LPA (Single) | £ 595.00 |

| UK Will & Two LPA’s (Single) | £ 795.00 |

| UK Mirror Will & Two LPA’s (Couple) | £ 895.00 |

| UK Mirror Will (Free) & Four LPA’s (Couple) | £ 1,195.00 |

| Product | Client Fee |

| UK Simple Will (Single) | £ 149.00 |

| UK Simple Will (Mirror) | £ 249.00 |

| Lifetime Will Storage | FREE |

| Registration on the National Will Register | FREE |

| Scotland Document Preparation (Including OPG Registration) | Client Fee |

| Continuing & Welfare Power of Attorney Documents (Single) | £ 495.00 |

| Continuing & Welfare Power of Attorney Documents (Couple) | £ 695.00 |

Registration with the Office of the Public Guardian is £83 per POA document. This is the fee charged by the court.

If you are in receipt of certain benefits, you can apply for free registration with the OPG.

Lifetime Solutions will assess your eligibility and help you complete the required forms for this as part of our service.

All Wills include free lifetime storage of your original Will and registration on the National Will Register.

| Package Deals (Registered) | Client Fee |

| UK Will & Continuing & Welfare Power of Attorney (Single) | £ 595.00 |

| UK Will & Continuing & Welfare Power of Attorney (Couple) | £ 875.00 |

Help

Frequently Asked Questions

Why do I need a Will?

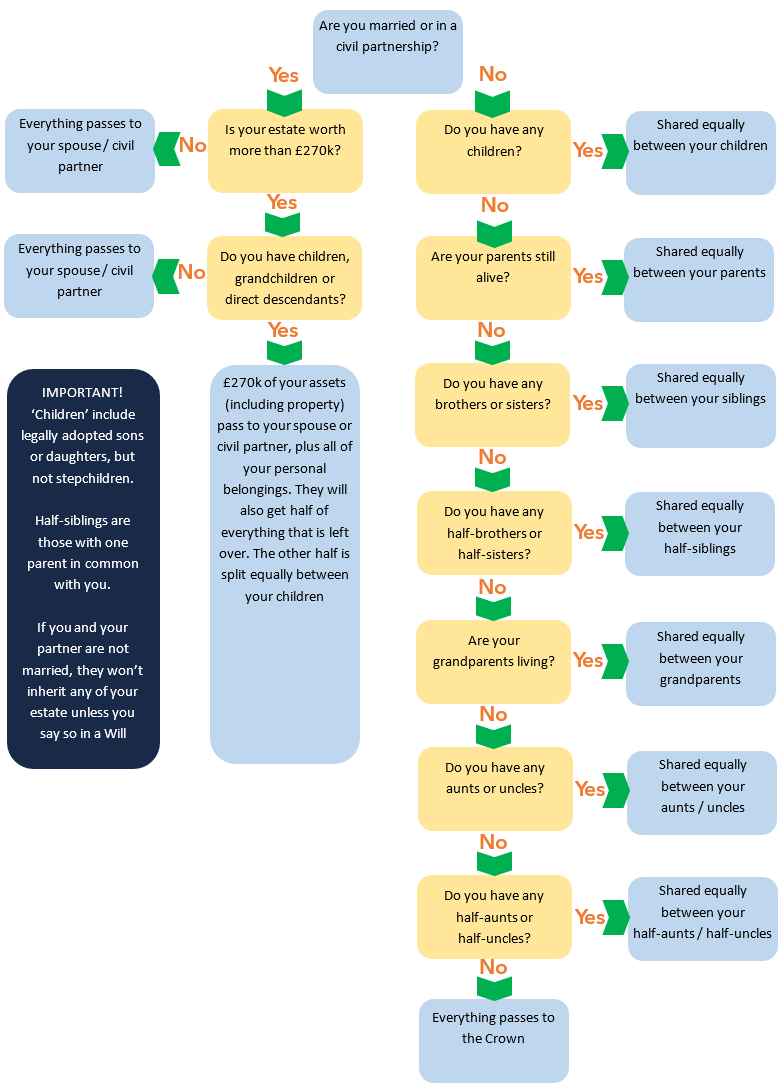

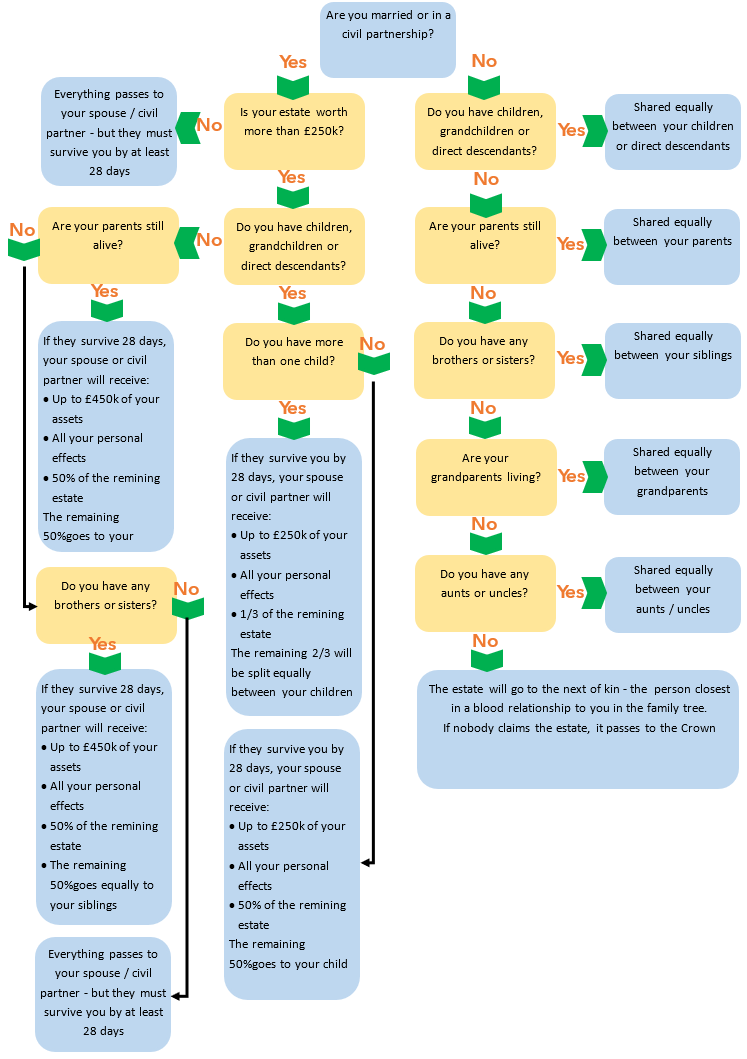

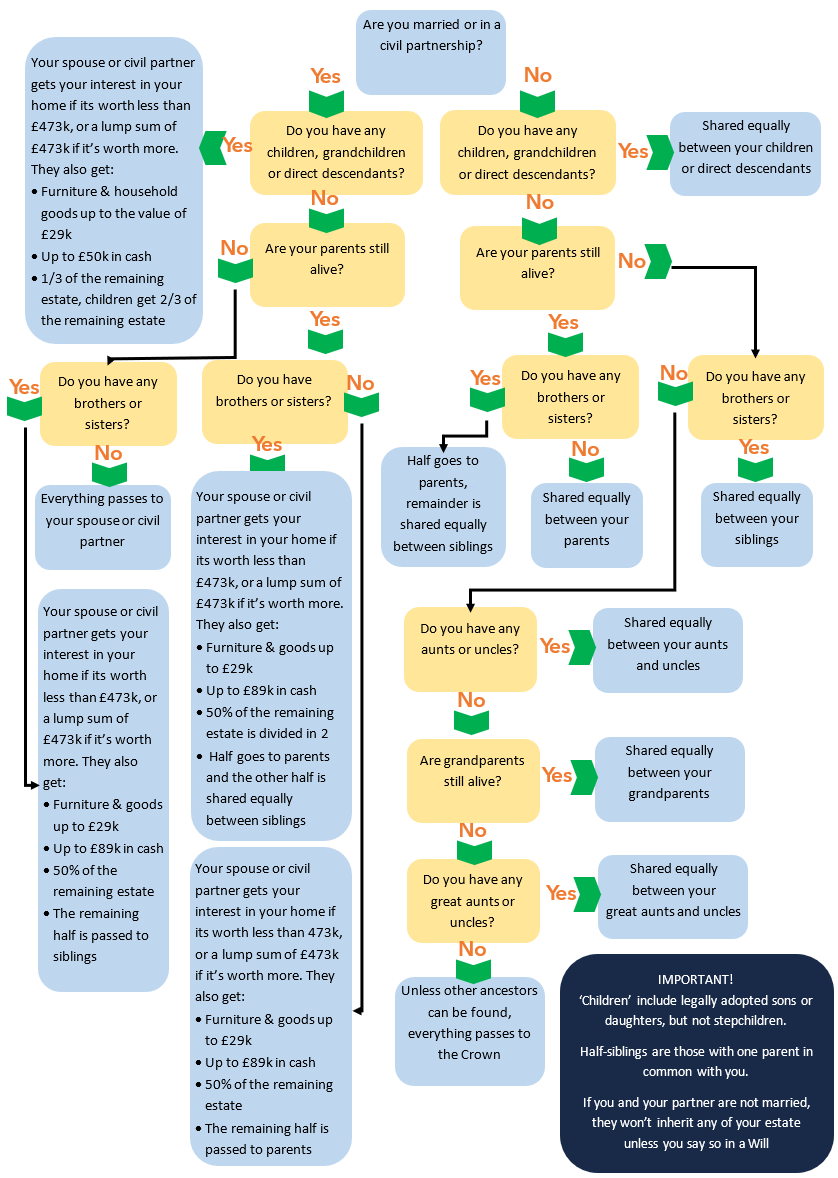

The only way to ensure that your wishes are carried out in the way you want them to be after your death, is to make a Will. If you die ‘intestate’ (without a valid Will), then in effect, the Government make your Will for you. Intestacy dictates that your assets will be divided up by a set of rules based on who you are related to by blood or marriage (even if you are separated).

These rules will not consider ‘common law’ partners and will not take into account any ‘estranged’ relationships, so if you have fallen out with someone you are related to, they may still inherit from your estate even if you don’t want them to.

What if I die without a Will?

Dying without a Will is called ‘intestacy’. If this happens, effectively, the law writes your will for you and there is a process that must be followed.

Below we show you what happens in intestacy, depending on where you live in the UK.

England & Wales

Northern Ireland

Scotland

What is a Will Trust?

A Trust is a legal structure which can be included as part of your Will and can offer increased asset protection for your loved ones. These types of Wills are called Will Trusts. It may be appropriate that you consider the benefits of setting up a Trust as part of your Will. They are most commonly seen in the following circumstances:

- You wish to protect your estate against possible care fees in the future

- You have a spouse or partner but have children from a previous relationship who you wish to benefit from your estate

- You wish to leave some of your estate to a vulnerable or disabled person

Why do I need a power of attorney?

If you become unable to manage your own affairs, a Power of Attorney grants someone of your choice, the power to act for you. They will be legally allowed to deal with your financial affairs and in some areas of the UK, health matters. This can either be permanently or even temporarily, if you were ill or needed some extra short-term support or help with complicated financial matters.

This ‘legal authority’ is vital because banks, pension companies, utility providers, government departments, charities, the NHS or any legal entity that deals with your personal information, health needs, or finances will not deal with someone on your behalf without having the correct permissions in place, even if it is your spouse. This is for good reason, as they are legally liable and face enormous fines for mis-handling your data.

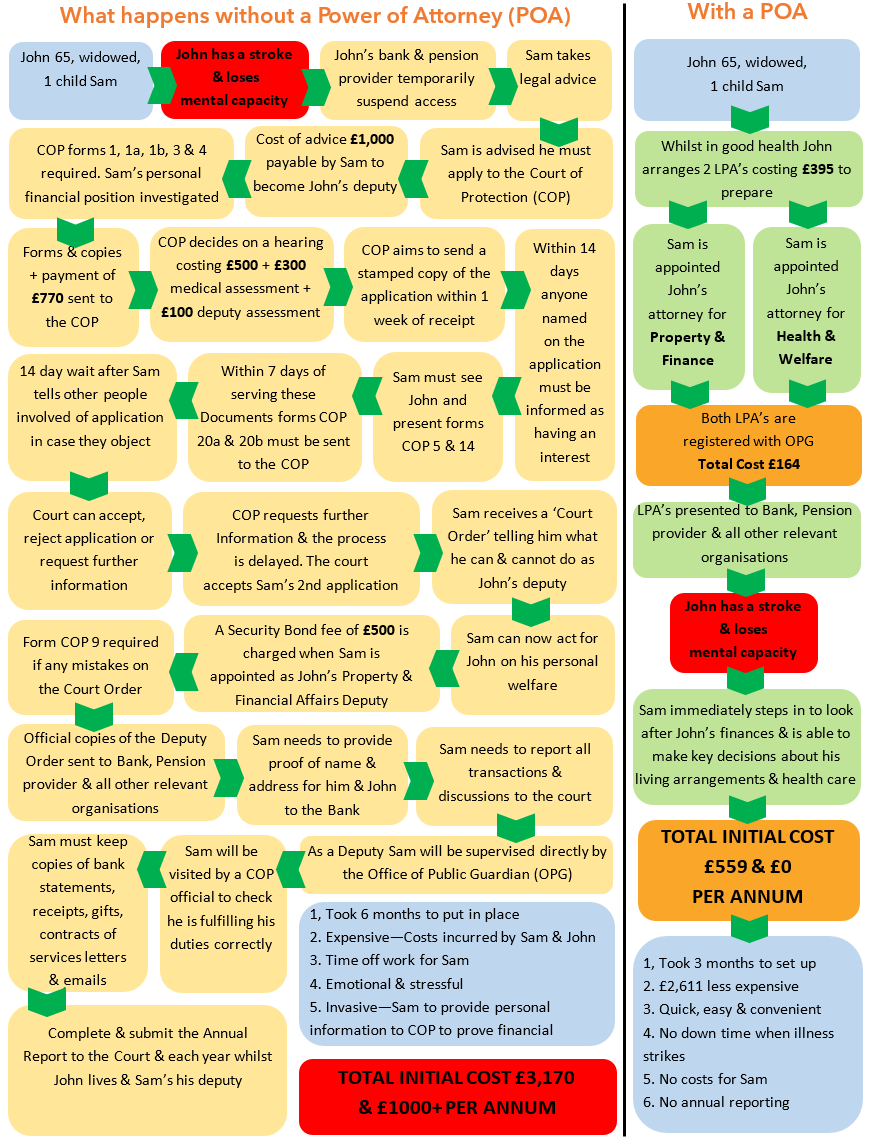

What if I lose capacity?

A common question we ask our clients is: “If you were unable to manage your own affairs, do you have someone who you would trust to look after them for you?”

Most people answer “Yes”, a spouse, son, daughter, brother, sister etc.

Our next question is: “Is there a legal document in place giving them the authority to act on your behalf?”

Unsurprisingly the most common answer to this question is “No”. Many of us don’t consider the implications of losing physical or mental capacity (permanently or temporarily) before we have made arrangements to protect ourselves, our estate, and our families.

The diagram below explains what happens if you lose capacity in England or Wales without having a Lasting Power of Attorney in place (it’s a similar process in Scotland).

On the left it shows the process your family would have to use to apply to court for a Deputyship order. On the right the process if you have a Lasting Power of Attorney when capacity is lost.

Are POAs the same around the UK?

In the UK, the national regions have different laws and documents to cover the range of powers granted.

Lasting Power of Attorney (LPA) England / Wales

The laws covering England and Wales are the same and on *October 1st 2007 the government launched Lasting Powers of Attorney. There are two types of LPA in England and Wales:

- Property and Finance LPA allows your chosen person to handle your bank accounts, investments, bills, property, and all financial matters.

- Health and Welfare LPA covers decisions about your health, medical treatment, wellbeing and personal care.

*Prior to October 2007, there was a single document called an Enduring Power of Attorney covering only Property and Finance. These documents are still valid and in use, however, you cannot make a ‘new’ EPA since the changes came into effect. These documents need to be registered with the Office of the Public Guardian (OPG) to enable them to be used. The Health & Welfare LPA can only be used once the donor has lost mental capacity, however, the Property & Finance LPA can be used as needed. The institution will normally need to receive a certified copy of the original document, or the original document itself so your attorney can act for you.

Continuing & Welfare Power of Attorney (CWP) Scotland

In Scotland, there are two powers of attorney (Continuing POA and Welfare POA), however, they are usually combined into a single document called a Continuing & Welfare Power of Attorney. This covers both Property / Finances and Health / Welfare. It can be set up to be used immediately or when the donor has lost capacity.

Enduring Power of Attorney (EPA) Northern Ireland*

In Northern Ireland there is single POA called an Enduring Power of Attorney which only covers Property & Finance.

*Currently we are unable to arrange NI EPA’s.

Request A Callback

Get great advice, straight from the heart. Request a call back for a free, no obligation and friendly consultation.